From Crypto Confusion to Clarity: AIXA Miner Simplifies Cloud Mining for All in 2025

Despite a turbulent market and the perplexity that surrounded crypto investing, AIXA Miner is still making things simple by turning cloud mining into a no-effort, accessible, and money-making venture for everybody, from the beginner who is still in doubt to the expert who is most crypto addicted. In 2025, as traditional investment methods become more and more questioned, many users decide to invest in passive income tools such as cloud mining. AIXA Miner is still at the forefront of that transition, with AI-optimized solutions, easy mobile access, and highly flexible contracts. If you want to mine Bitcoin, Ethereum, or Dogecoin, AIXA Miner will allow you to do all this with your smartphone only. No hardware. No maintenance. Just smart earning.

Cloud Mining Doesn’t Have to Be Complicated: AIXA Miner Makes It Simple, Smart & Mobile

The popularity of the AIXA Miner has seen a significant growth that can be linked to the fact that it is an integrated cloud mining platform that eliminates the traditional problems of hardware cost, complicated arrangements and energy consumption. On the other hand, the users are required only to register an email to start an AI-powered intelligent mining system.

Why Crypto Investors Are Choosing AIXA Miner in 2025

- $20 Free Welcome Bonus for New Users – Anyone who registers on AIXA Miner gets a $20 bonus right away—no deposit required. It is a kind of live mining experiment and also a way to generate crypto income before committing any funds. The offer is excellent for those who are new to cloud mining and want to go in without risk.

- AI-Optimized Mining Engine – In contrast to the platforms that have static strategies, AIXA Miner does hash power allocation dynamically to those coins which are most profitable in real-time. The system always mines the most profitable coins among BTC, ETH, DOGE, thus users can maximize their profit effortlessly.

- Alliance and Affiliate Program for Income Multiplication – AIXA Miner’s affiliate structure is not only easy to use but highly rewarding. Earn 5% commission on your referrals’ contract purchases. Benefit from the Alliance Member Activity, where top referrers unlock milestone rewards, ranging from cash prizes to limited contract bonuses. Weekly events encourage teamwork and allow users to grow their downline for long-term earnings.

- Eco-Friendly Cloud Mining – Operating on solar and wind energy, AIXA Miner is definitely a sustainable energy project that focuses on environmental responsibility. The low-carbon infrastructure of the company allows users to be completely aligned with their green energy principles while enjoying their crypto passive income as it is not polluting the planet.

- Fully Compliant & Certified – AIXA MINER CLOUD MINING INVESTMENT LTD is a company registered in the United States of America and holds a FinCEN certification. It goes a step further in the process of establishing trust by making sure that the operation complies with the law. Users can feel comfortable because security is strong, operations are transparent, and there are no legal obstacles.

- Mobile-Ready and Intuitive App Experience – Whether you’re at home or on the go, the AIXA Miner app is optimized for both Android and iOS. You can follow mining operations, reinvest, withdraw, and upgrade all from a user-friendly dashboard. No technical experience is required. You can download here.

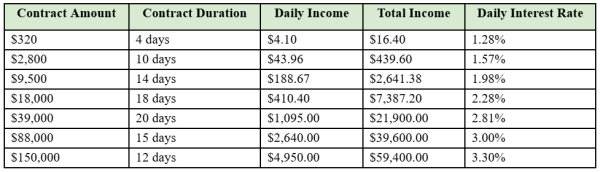

AIXA Miner Contracts: Created for Every Budget and Financial Target

Regardless of your investment amount or timeline, AIXA Miner has a mining contract that fits your requirements. These are the new contract plans for 2025:

All agreements ensure that the total principal will be returned after the maturity date, thus providing an additional layer of financial security.

Exclusive Perks for 2025: Bonuses, Buybacks & Multicurrency Support

- DOGE Deposit Exclusive Event – Our customers who place their contracts with Dogecoin will be given a 1% cashback bonus, alongside gift tiers ranging from $7 to $977, depending on the contract size.

- VIP Club Access – Those who are high-tier users can have all the fun they want in exclusive VIP contracts, be the first to try out new features, and get monthly dividends. The yield of some VIP contracts goes beyond $7,800 per day, which makes them the best choice for high-capital investors.

- Flexible Payout Options – People are free to decide in which cryptocurrency they want to get their daily mining rewards among BTC, ETH, USDT, DOGE, or XRP—they will be able to do it smoothly and without a hitch of diversifying their wallets.

- Full Digital Ecosystem – The platform enables smooth reinvestment, real-time withdrawal tracking, and seamless integration with trusted exchanges like Binance, OKX, Kraken, and Coinbase (tutorials available here).

Getting Started with AIXA Miner Is as Easy as 1-2-3

1. Register Your Account Go to AIXA Miner official

2. Pick The Correct Agreement; Have access to mining contracts customized for different financial objectives and risk capacities.

3. Start Mining and Earning Daily; Once you activate, you will be given crypto daily payouts and you will be able to track your portfolio growth straight from your dashboard or mobile app.

About AIXA Miner

AIXA MINER CLOUD MINING INVESTMENT LTD (AIXA Miner) is a cloud mining pioneer in the mining industry. Founded in 2020 and located in Greenwood Village, Colorado, the company is fully compliant with the local authorities and is FinCEN registered. This is proof of the company’s dedication to regulatory compliance and user protection. AIXA Miner is responsible for over 125 power plants that are distributed all over the globe, and these power plants are run by clean energy. This allows users from every corner of the globe to mine crypto in a way that is not only efficient but also safe and environmentally friendly. The central objective of the platform is to decentralize the mining of digital assets through the facilitation of one-click cloud computing for all at any location.

#BitcoinMining

#AICloudMining

#CryptoPassiveIncome

#DogecoinMining

#AIXAMinerContracts